Here are links to chart deck and video …

MFOP 2025 Mid-Year Review Chart Deck

MFOP 2025 Mid-Year Review Webinar Video

———–

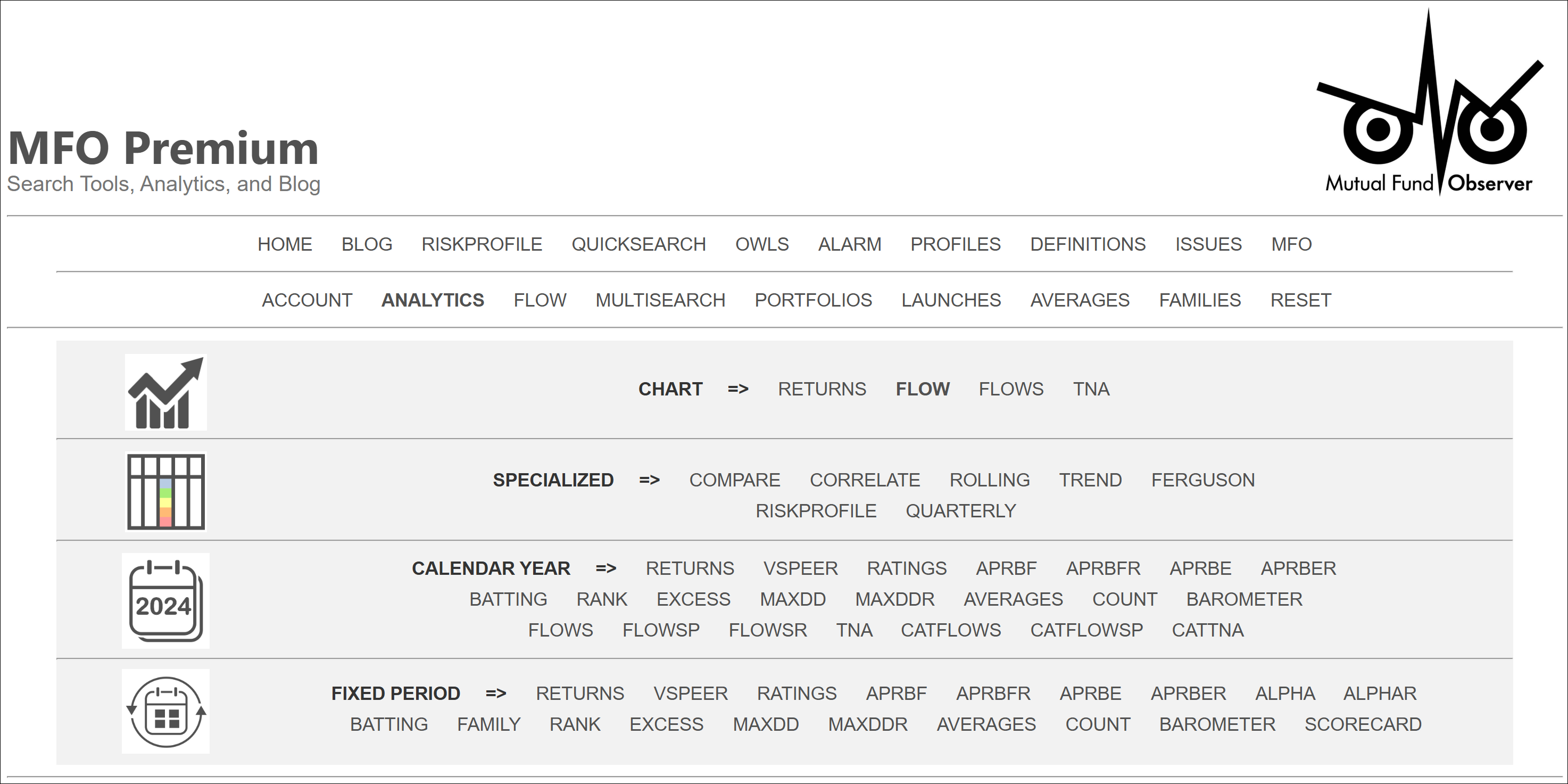

We’ve scheduled our mid-year review webinar for Thursday, 3 July at 11 am Pacific (2pm Eastern). We will use MultiSearch ANALYTICS and PreSet Screens to highlight performance of funds across different market segments. Please join us by registering here.

A couple improvements so far this year:

- Automated evening fund flow downloads from Lipper enabling Daily FLOW Updates, which will depict fund flow, AUM, and return through the previous business day, as applicable.

- Worked with Allan Jardine, creator of DataTables, which drives our search engine, to improve the speed to manipulate very large tables, like MultiSearch (e.g, over 600 columns and 20 rows). Test case improved from 50 seconds to under 1 second!

- Added Trump 2.0 Display Period, which reflects risk and return metrics since January 2025, so should match YTD through rest of year.

June marked the 42nd month of The Great Normalization (TGN) market cycle and the 33rd month of this market’s bull run, including 12 months at all-time highs. The run has propelled the S&P 500 80% so far, netting buy-and-hold investors 37% after the -24% drawdown in 2022. And it extends after the significant intra-month drop from April’s “Liberation Day” announcement. Bonds remain generally depressed.

Here’s summary of S&P 500 full-cycle performance going back nearly a century, comprising seven full cycles:

Here’s breakout of bear and bull markets for each of those same seven cycles:

Here’s summary for several key indexes plus BRKA for each of those same seven cycles, followed by plot of returns since start or current The Great Normalization cycle in January 2022: